Using solar energy is a smart strategy for any business. With numerous incentives available, it’s easier than ever for businesses and nonprofits to go solar.

More Commercial Solar

With all the available incentives, using solar energy is a smart strategy for any business. Here are the three main solar incentives available to Massachusetts businesses.

Performance Incentives

Earn money for every kilowatt-hour of energy that your system produces for 10 years.

Tax Credits

Collect tax refunds from the state and federal government to offset the cost of your system.

Net Metering

Earn credits on your electric bill for the excess energy your solar system produces.

Tax Credits

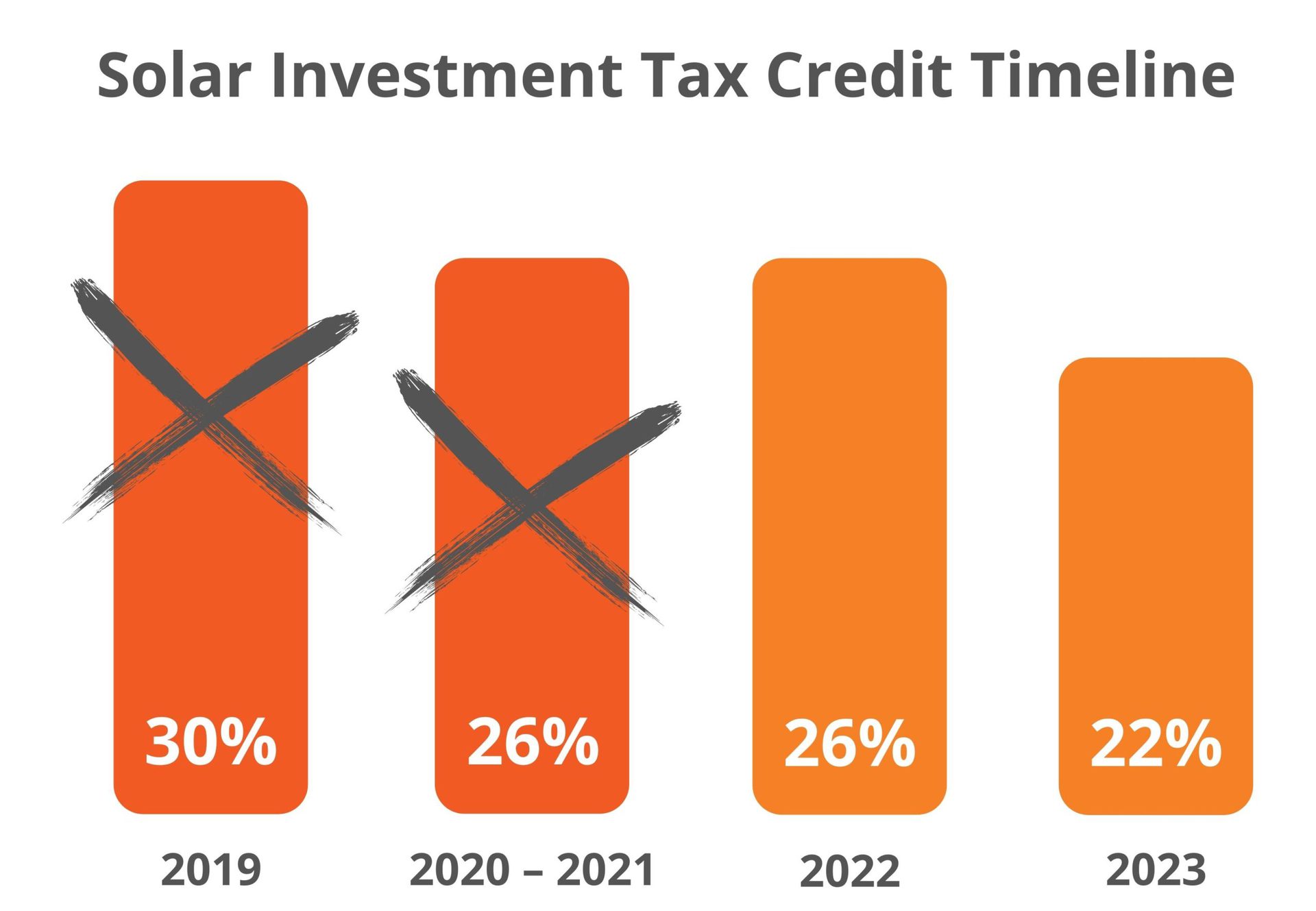

Through tax credits, properties are able to earn back some of the cost of their solar installation through the Federal Investment Tax Credit (ITC). There is a timeline for this program and the tax credit that will slowly decrease over the next few years. Here is the current schedule:

- 2021 – 26%

- 2022 – 26%

- 2023 – 22%

- 2024 – 10%

Modified Accelerated Cost Recovery System (MACRS)

The Modified Accelerated Cost Recovery System (MACRS) helps businesses recover costs through annual depreciation tax deductions. Businesses can value solar as “five-year property” and claim a tax deduction, meaning that businesses can depreciate that asset over five years. There is another option to have an accelerated depreciation schedule, which results in the full benefit being claimed in the first year of operation.

If the ITC is also claimed, the system owner must reduce the project’s depreciable basis by one-half the value of the tax credit. Simply put, with the current 26% ITC, commercial solar customers can multiply 87% (100% – 13%) of the total installed cost of their system by their tax rate and deduct that amount from their tax basis in the first year that the system is installed.

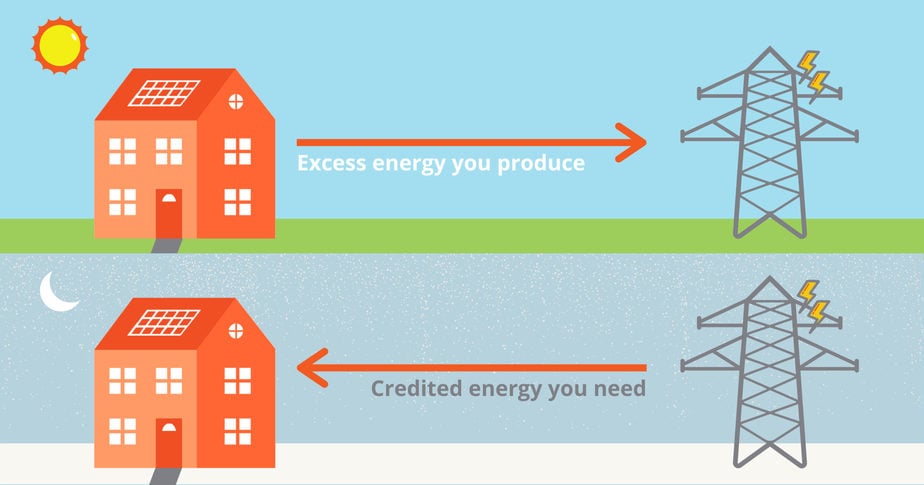

Net Metering

Net metering allows most grid-tied system owners to send excess electricity to utilities in exchange for credits on their electric bill. At the end of your billing cycle, your remaining credits are rolled over to the next billing period, and you can use these credits when your solar production is lower. In New England, solar systems generally overproduce electricity in the spring and summer, earning credits to use during the winter months when energy production is lower.

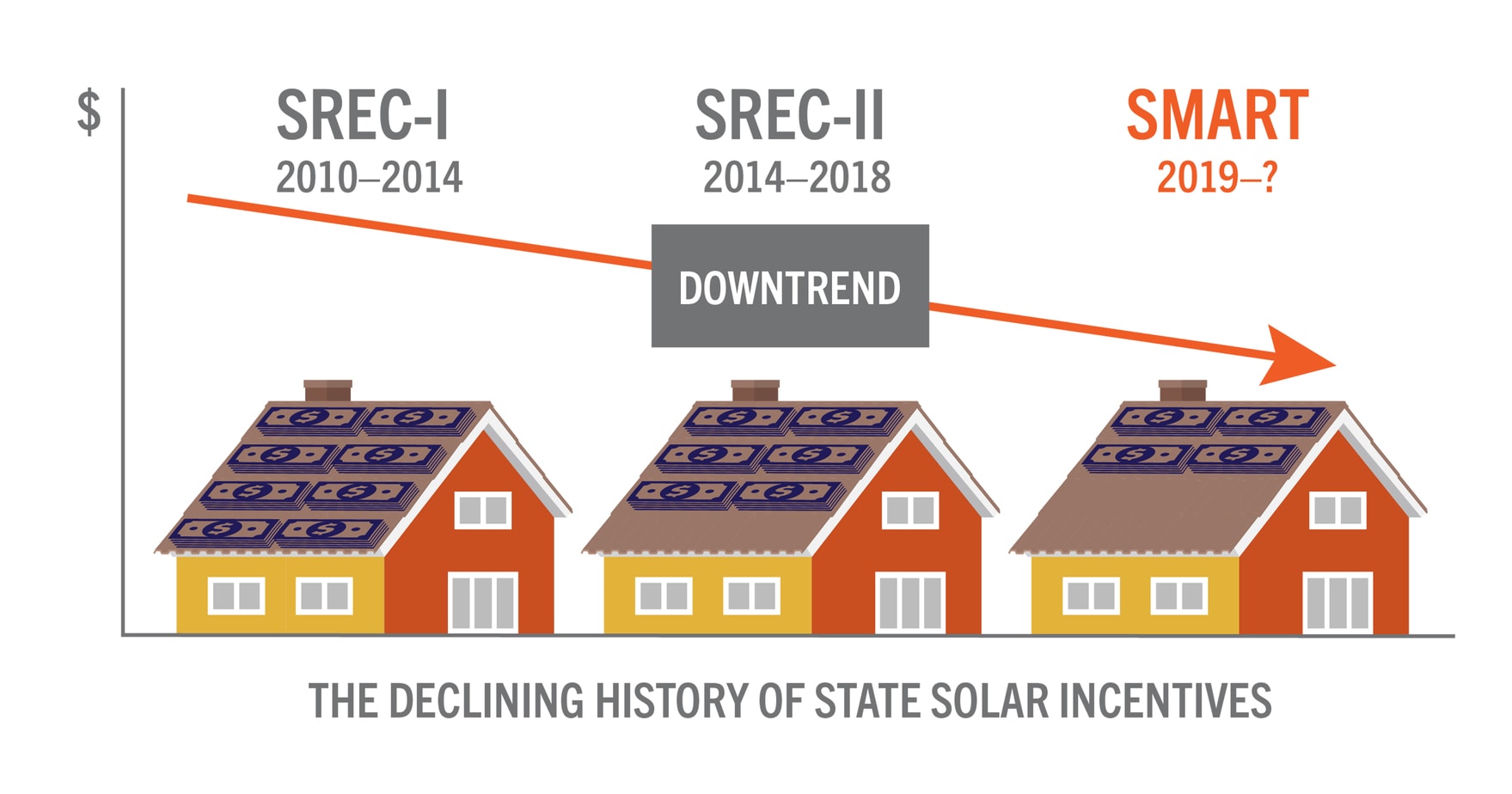

SMART Program

The Solar Massachusetts Renewable Target (SMART) Program is a performance-based incentive program that compensates you for the electricity you produce. You’ll receive a check based on your energy production each month for 20 years with commercial projects that are larger than 25 kW. If your project is smaller than 25 kW, you’ll receive a check for 10 years.

Commercial Solar FAQs

What do you mean by depreciation and cost recovery?

Depreciation is when you deduct the cost of your asset over its useful lifespan. Cost recovery is closely related, as it is the depreciable life for the asset. Cost recovery is the amount you earn back on some of the costs of the asset. If you want to learn more about how depreciation works, the IRS has a page dedicated to explaining it here.

Is there a limit to how much my business can net meter?

There is not a general cap designated for all commercial solar installations, but instead net metering limits are based on the utility company in the project area. Each of the utilities has a cap with net metering, and Massachusetts has an online application to see if any property can participate in the program. Solaris Renewables can help you determine your local net metering policy.

Why do some of the incentives decrease over the next few years?

Similar to most incentive programs, solar incentive programs decline over time as adoption of solar increases. Both federal and state governments try to get as many commercial businesses on board with renewable energy as soon as possible. This is why there is no time like the present, to maximize your financial gain for your business and solar investment.

Do SMART incentives change?

Yes, everyone gets different incentives all depending on when they get installed with solar. Because it is set up as a declining block structure, the rate you get paid depends on which block you fall into. However, once you’re locked into that incentive program, you’re in that program for the locked in number of years. Solaris Renewables will make sure that you’re locked into the best incentive program available.

Are all solar customers able to participate in SMART?

To be eligible for the SMART Program, your business must be in Eversource, National Grid, or Unitil territory. At this time these are the only utility companies partnered with the Department of Energy Resources. Solaris Renewables can let you know if you are eligible to participate in the SMART Program and fulfill all applications for you.

Where do I go to learn more about the ITC?

If you are looking for more information about the federal tax credit, the US Department of Energy has a detailed breakdown of it. You can also ask your tax accountant any additional questions you may have about your eligibility.

How do I go about getting the incentives on my tax return?

We recommend talking to your tax expert in regards to all the possible incentives for getting solar. While we have a general understanding of how the programs work, we cannot provide tax or financial advice. We recommend consulting with your accountant to figure out which tax deductions work best for your company’s property.