It pays big to go solar. Besides saving money on your electric bill, purchasing solar panels brings huge benefits to homeowners. There are three major incentives for going solar: the SMART Program, federal & state tax credits, and Net Metering.

Performance Incentives

Earn money for every kilowatt-hour of energy that your system produces for 10 years.

Tax Credits

Collect tax refunds from the state and federal government to offset the cost of your system.

Net Metering

Earn credits on your electric bill for the excess energy your solar system produces.

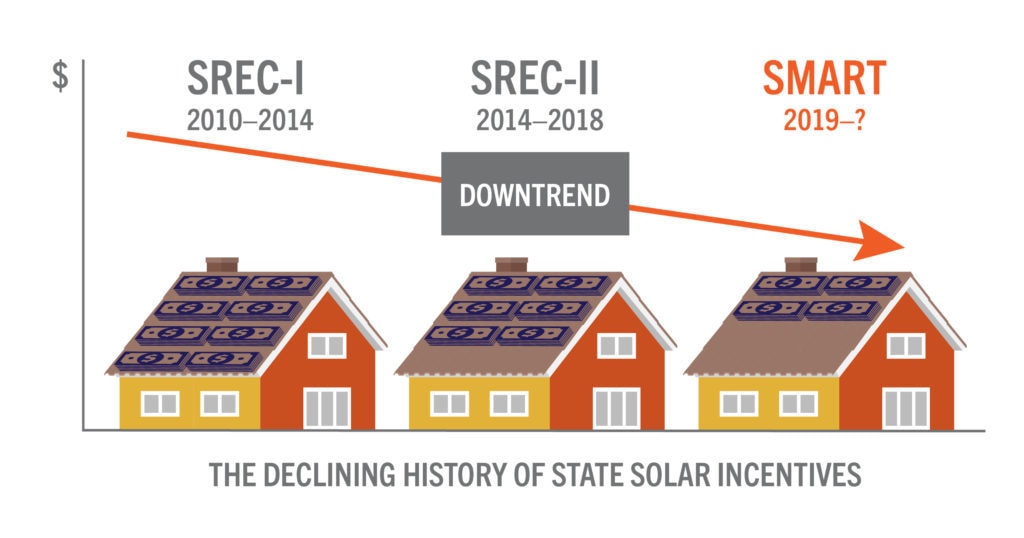

SMART Program

The Solar Massachusetts Renewable Target (SMART) Program is a performance-based incentive that compensates you for the electricity you generate. For ten years, you’ll receive a monthly check based on your electricity production.

With SMART, the longer you wait to go solar, the less financial incentive you receive because it’s structured as a declining block model. When you sign up for solar, you’re assigned to a block that dictates the rate you’ll be compensated. However, these blocks have a fixed solar energy capacity (in megawatts), and once the blocks fill up, new solar owners go to the next block where they receive a lower incentive rate.

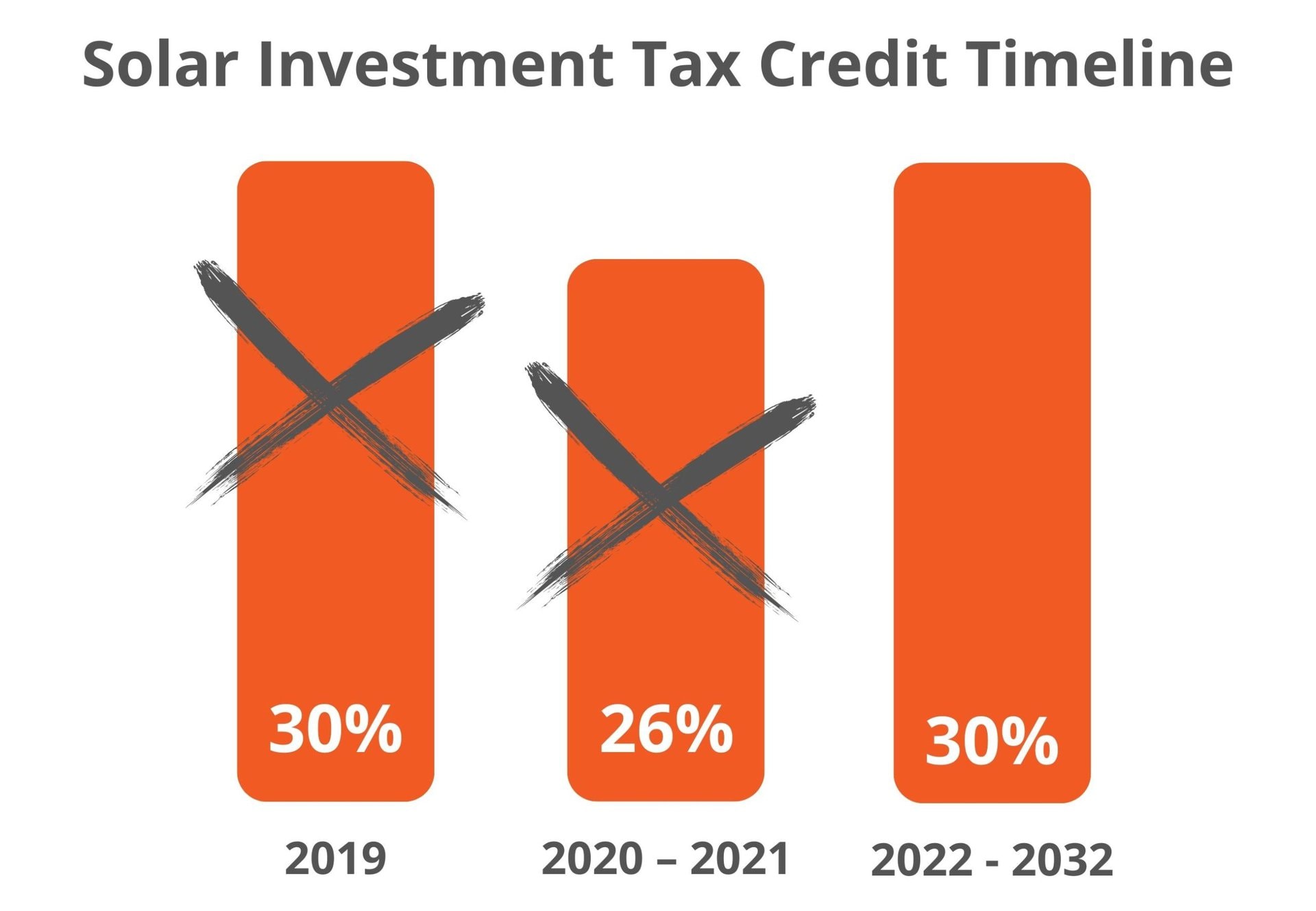

Tax Credits

Along with a 15% Massachusetts state tax credit worth up to $1000, the Federal Investment Tax Credit (ITC) refunds you on your tax return for 30% of the total cost of your solar installation. This includes roof work or a new roof, tree removal, electrical upgrades, and anything else needed for you to go solar.

Net Metering

Many grid-tied solar owners also earn money through a billing mechanism called net metering. When your system produces more energy than you need, the surplus electricity is sent to the grid and you earn credits for it. You can utilize those credits to pay your electric bills in months when your production is lower. In New England, you generally overproduce electricity in the spring and summer and in the winter months, because production is lower, you can use the credits you have accumulated.

Factors and Incentives that Influence How Solar Will Work for You

In this video Vice President of Solaris Renewables, Brian Sadler, talks about 3 factors that influence how solar will work for you, and 3 incentives to help offset the cost.

Maximize Your Investment

The best time to invest in solar is now. We can help you navigate federal and state incentives, so your solar system can earn you money while it saves you money.