What is the Federal Solar Tax Credit?

The Federal Solar Tax credit, also known as the Investment Tax Credit (ITC), is a major federal initiative that supports solar growth throughout the nation. Equal to 26-percent of the total installation cost, the Federal Solar Tax Credit allows homeowners and businesses buying solar to see a much quicker return on their investment.

With no cap, the deduction includes every aspect of a solar installation for commercial and residential projects alike. Should you need to have your roof repaired or replaced in order to go solar, those costs can be deducted as well. These savings don’t include the added benefits of state incentives, like SMART. However, SMART incentives are also facing a decline.

Societal Impacts of Clean Energy Policy

While rewarding the owner of the solar system, solar incentives like the Federal Solar Tax Credit also boost the economy as a whole. This incentive amplifies society’s demand for solar power, which in turn increases the need to fill solar jobs. Solar is one of the fastest-growing job markets in the US today, creating huge economic growth. The solar industry alone accounts for nearly 250,000 jobs across the country and continues to expand with over 25 states seeing growth in 2018. The industry contributed $17 billion to the US economy in 2018 alone.

Greater solar adoption also helps make clean energy the norm and even the expectation. The Federal Solar Tax Credit is so compelling to homeowners and businesses that it helps both the state and nation to meet its renewable portfolio standards (RPS) and climate goals. Since it was originally enacted in 2006, the tax credit has contributed to solar industry growth of more than 10,000-percent. These results pushed its renewal in 2015. Incentives influence many to go solar, making it much harder to decrease our carbon footprint without them. Incentives propel America into an affordable, clean energy future.

Disappearing Solar Incentives

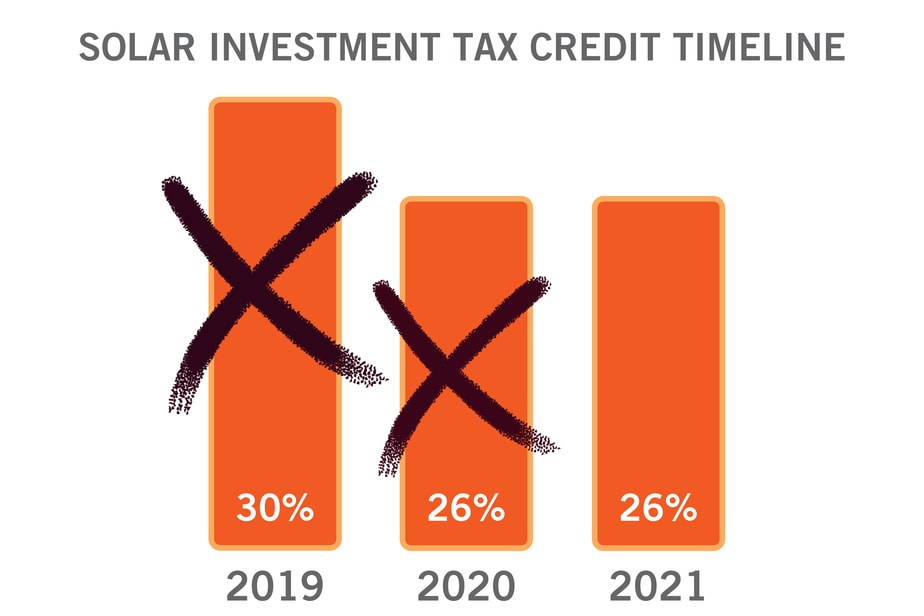

With all these benefits, solar may sound too good to be true, and in a way it is. Solar incentives are quickly declining. The Federal Solar Tax Credit dropped to 26-percent in 2020 from 30-percent in prior years. By 2022, the credit will be gone completely for residential installations.

Over the next few years, that’s a $1,800 savings loss and after 2022, the Federal tax credit for solar will no longer exist. As of right now, there’s nothing in place to offer savings this substantial, creating a major loss for those who wait to go solar.

Currently, lawmakers are submitting proposals to renew the tax credit at its full 30-percent rate. Senators and representatives claim these proposals “create jobs, bolster the economy and address climate change.” While this initiative brings hope, there is significant uncertainty, especially with big elections looming on the horizon.

How Do State Incentives Play a Role?

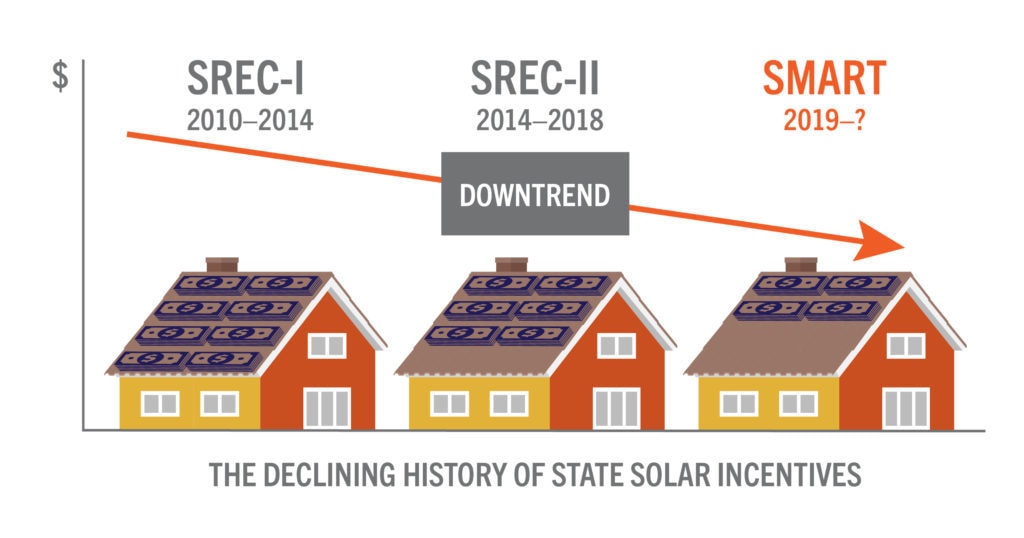

If you’re considering going solar, there’s no time like the present. But, this isn’t a secret. The recent drop in incentives is motivating homeowners to begin the solar process now, causing state incentives to dwindle.

The Solar Massachusetts Renewable Target (SMART) Program is another incentive to go solar that’s exclusive to Massachusetts homeowners and businesses. However, SMART’s available incentives decrease as more people take part. Those who make use of the SMART program sooner will receive greater financial gain compared to individuals who wait. With people rushing to install before the end of ITC, SMART blocks are filling up quickly causing state incentives to dwindle. Not only should you begin your solar journey now to take advantage of the ITC, but also to beat out your neighbors for shrinking SMART incentives. These multilayered savings make solar an affordable, worthwhile investment.

Claim Your Solar Savings

Whether you’ve been planning to go solar for some time now or are just beginning to consider the idea, we highly recommend taking the leap. Conventional electricity from the grid is far dirtier and more expensive than producing your own energy.